Credit card processing you can count on, with CASHlynk

When you're processing hundreds of transactions a day, you need to make sure whenever someone swipes their card, it's smooth, easy, and cost-effective for your bottom line.

Our credit card processing services in Iowa are tailored to meet the needs of businesses of all sizes, providing secure and rapid transaction processing that you can depend on. With advanced technology and a customer-focused approach, we ensure that every transaction is handled with utmost care, allowing you to focus on other aspects of your business. Additionally, our pricing models are designed to help you save on processing fees, further boosting your bottom line.

Take the next step towards seamless business operations by contacting CASHlynk for a free consultation today. Let our expert team show you how our credit card processing solutions can enhance your business's efficiency and profitability. Call us now at (319) 892-0136 to get started and experience the difference our services can make for your business.

Different Types of Credit Card Processing

Traditional (interchange +)

CASHlynk offers traditional interchange-plus pricing, a transparent and cost-effective model for credit card processing. This method involves a fixed markup over the actual cost set by card networks (interchange fees). Businesses benefit from knowing exactly how much they are paying for each transaction, ensuring there are no hidden fees. Our competitive rates and reliable service help you maximize savings and streamline your payment processing.

Cash discounting

Our cash discounting program allows merchants to offer customers a lower price for paying with cash. This approach helps you offset credit card processing fees by passing a small fee onto customers who choose to pay with a card. By incentivizing cash payments, businesses can reduce processing costs and increase cash flow, all while maintaining customer satisfaction.

Surcharging

CASHlynk provides surcharging solutions that comply with all state and federal regulations. This program allows merchants to add a small fee to credit card transactions, effectively covering the cost of processing fees, and helping you save significantly on transaction costs without impacting profit margins. Our team ensures seamless implementation and clear communication to your customers.

Dual pricing

With dual pricing, merchants can display two prices for each product or service – one for cash payments and one for credit card payments. This transparent approach educates customers on the cost of using credit cards and encourages cash transactions. Dual pricing is a straightforward way to manage processing fees while giving customers the choice of payment method, and CASHlynk can fully support businesses in setting up and managing dual pricing systems efficiently.

Non-cash adjustment

The non-cash adjustment program allows businesses to implement a small price increase for non-cash transactions, helping to cover the costs of credit card processing. This method differs from surcharging in that it adjusts the overall pricing structure instead of adding a fee at the point of sale.

Customers paying with cash enjoy a discount, while card users cover the additional cost, which helps strengthen your bottom line while maintaining compliance with industry standards.

Benefits of credit card processing

By integrating a robust credit card processing system from CASHlynk, you can streamline transactions, enhance security, and improve customer satisfaction.

How? Well, let's explore a little:

Improve efficiency

Our credit card processing systems are designed to handle high volumes of transactions quickly and accurately, reducing wait times and improving overall proficiency.

A security buff

With advanced security features, our credit card processing solutions help protect your business and customers from fraud and data breaches.

Increased customer satisfaction

Providing multiple payment options, including credit card processing, makes it easier for your customers to complete their purchases, leading to higher satisfaction and repeat business.

Example: how CASHlynk's credit card processing can benefit a restaurant

Imagine a bustling restaurant in Cedar Rapids that experiences high foot traffic, especially during peak hours. By integrating CASHlynk's credit card processing system, the restaurant can streamline its payment process in several ways:

Faster transactions

CASHlynk's system processes credit card payments quickly, reducing wait times for customers. This means diners can pay their bills promptly, freeing up tables faster and increasing the restaurant's turnover rate.

Buttoned-up security

With built-in security features, CASHlynk's credit card processing protects both the restaurant and its customers from potential fraud and data breaches. This ensures a secure transaction environment, fostering trust among patrons.

Better customer experience

By offering multiple payment options, including credit and debit cards, the restaurant can cater to a wider range of customer preferences. This convenience enhances the overall dining experience, leading to higher customer satisfaction and repeat visits.

Streamlined operations

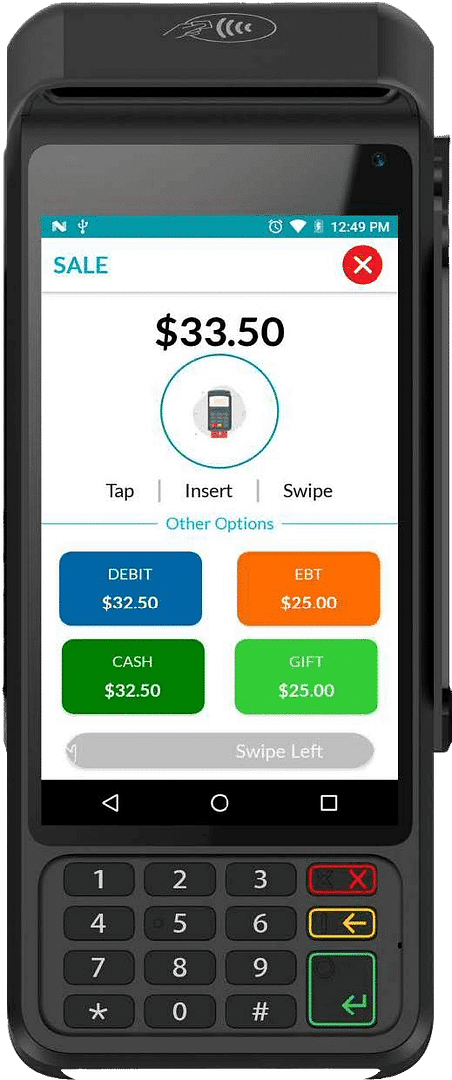

CASHlynk's credit card processing system integrates seamlessly with the restaurant's point-of-sale (POS) system, simplifying accounting and financial management. This allows restaurant staff to focus more on providing excellent service rather than dealing with complex payment processes.

By choosing CASHlynk, the restaurant can enjoy these benefits and more, ensuring smooth operations and a better dining experience for their customers. Contact CASHlynk today to learn how we can help your restaurant thrive with our comprehensive credit card processing solutions.

Credit card processing FAQ

What is credit card processing?

Credit card processing is the procedure through which businesses accept and process credit card payments from customers. This involves the transfer of transaction information between the business, the credit card company, and the customer's bank.

How can credit card processing benefit my business?

Credit card processing can increase sales by providing customers with more payment options, improve transaction security, and streamline the payment process, leading to increased efficiency and customer satisfaction.

What should I look for in a credit card processing provider?

When choosing a credit card processing provider, consider factors such as transaction fees, security features, customer support, and the provider's reputation.

Credit card processing in by local technicians

At CASHlynk, we are committed to providing reliable and efficient credit card processing services in Iowa and surrounding areas. Contact us today for a free review and consultation of your business systems. We're ready to step up as your trusted partner in business maintenance, offering comprehensive service packages designed to meet your unique needs.

Not all products and services may be available in your area. For more details or if you have any questions, please get in touch with us at (319) 892-0136 or visit our Cedar Rapids office at 234 33rd Street Dr. SE. We look forward to serving you!

24/7 on-call and local support

CASHlynk offers 24/7 on-call support to ensure that any issues or questions regarding your credit card processing services are addressed promptly. Our dedicated team of technicians is always available to assist you with any concerns, service requests, or technical support you may need. Don’t hesitate to call us anytime at (877) 322-4556.